A Realistic Post-Grad Budget

When I first graduated college, I had ZERO idea of how to budget. I knew what I would be making each year in total, but didn’t realize A: that taxes are withheld from paychecks, so I’d be taking home a lot less and B: that I needed to plan a budget on a month to month basis.

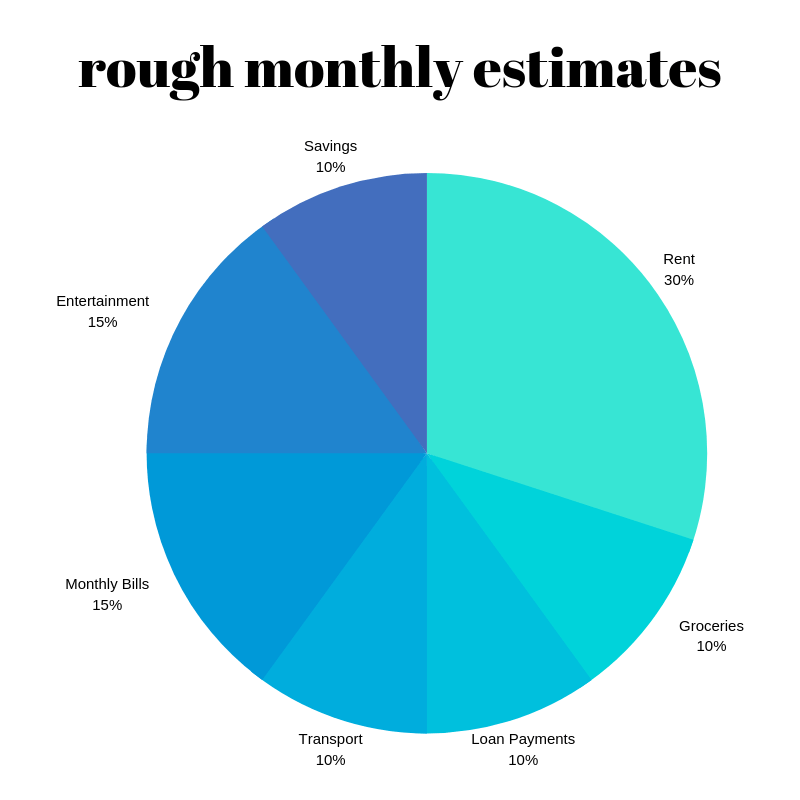

I ended up coming up with the following “rough estimates” on how I spent my monthly income. Obviously, this can differ based upon each person’s needs, but I still follow something close to this today!

Your main monthly expense categories with the estimated % of your income:

RENT (30%): Housing cost paid in full or split between roommates. It’s obviously the most expensive cost you have, but you don’t want to be “apartment poor” – our renter’s version of “house poor” – and overspend here. Get a nice, safe place to call home, but don’t go for the bells and whistles starting out.

GROCERIES (10%): It is so much healthier and cheaper to cook at home! Still, you need to budget or you’ll be overspending every time Trader Joe’s releases a new flavor of Joe Joe’s or cookie butter.

LOAN PAYMENTS (10%): Student loans, car loans… you should start paying these sooner rather than later. However, when you have just graduated, I would recommend only paying what you absolutely have to each month.

TRANSPORT (10%): Gas, transit fares, Ubers all need to be budgeted for. Ubers after nights out can particularly get expensive.

MONTHLY BILLS (15%): Phone bills, electric, heating, cable, internet, etc. fall into this category. I try to budget more than I necessarily need because my electric/heating bill always goes way up in winter.

ENTERTAINMENT (15%): Nights out, dinner, movie tickets, shopping, all that falls into this category. Some people may say I budget too little for this category but in my opinion, it’s smart to be mindful of how much you’re spending at brunches or bars with friends, because it adds up!!

SAVINGS (10%): Even though it can be tempting to just spend all the money you have left on drinks or clothes, I think it’s super important to start building up some “cushion.” You never know if you will have to foot some additional bills, have to book an unexpected flight home, repair your car, etc. so you want to prepare for this by having extra money set aside in savings.

I know a lot of you are beginning “big girl” jobs soon, and I hope this is helpful as you start getting paychecks! Welcome to the adult world, it’s not so bad once you know how to spend your money wisely 🙂